Tax filing: Research summary

The Tax filing optimization project kicked off in November 2017 with the goal of making it easier for Canadian businesses to fulfill their GST/HST and payroll obligations. Designers and researchers from the TBS Digital Transformation Office formed a multi-disciplinary team with the Canada Revenue Agency. The team included representatives from CRA’s user experience, web publishing, GST/HST and Payroll programs, as well as call centre agents who have provided direct assistance to Canadians.

Discovery

The team began by researching tasks on Canada.ca, using existing data sources.

The CRA conducts a monthly top task exit survey to find out more about how citizens use their digital services. It asks people who come to CRA pages what they were trying to do and whether they were successful. “File a GST/HST return” and “Calculate payroll deductions” are consistent top tasks.

Web traffic data showed that the pages for calculating payroll deductions and reporting payroll got over 4.2 million visits in 2017. The topic of GST/HST returns had over 1.3 million visits. Over 88% of people do these tasks on desktop or laptop computers, not mobile devices. This was helpful input for our test planning.

We analyzed the readability levels of the GST/HST and Payroll pages. Analysis confirmed quantitatively what people know intuitively: web pages about tax obligations are quite hard to read. About 24% of the text on key GST/HST and payroll pages used long sentences, and 17% was written in passive language. The Canada.ca Content Style Guide and plain language experts recommend using short sentences and writing in the active voice.

We were starting to understand the issues Canadians were facing when trying to fulfill their business tax obligations online. The next step was to confirm our hypotheses with remote moderated usability testing.

Establishing a baseline

To test our hypotheses, the team developed 16 possible tasks related to filing business taxes. We created a simple online survey so that CRA’s call centre agents and subject matter experts could comment on the tasks. With this input, we narrowed down the list to 10 task scenarios, confident that they were accurate and represented real issues for citizens.

- Can you pay your company's payroll CPP and EI deductions to CRA using Interac?

Yes - You issued an invoice, with GST included, on the last day of the quarter. Can you wait until the invoice is paid before sending in your payment?

No (We usually consider payment to be due on the date you issue an invoice...) - You accidentally made an error when you submitted your last payroll return. You under-paid your source deductions to CRA by $350. Will you get fined?

No because it was less than $500 and you didn't knowingly or under circumstances of gross negligence, fail to remit it - If your Ontario company sells and ships a taxable product to a customer in Alberta, do you charge them GST or HST?

GST (5%) only. Reason: Alberta does not charge HST - You mailed a cheque to pay your company’s payroll deductions. How would you confirm that the CRA received it?

Access account balance through My Business Account OR Represent a Client OR wait for Statement of Account - You registered for GST for the first time on August 31, and will file your return annually. Your fiscal year ended October 31. Your net tax for September and October was $2,500. Will you need to pay your GST in instalments for the next fiscal year?

Yes (> $3000) - A business collects taxes from its employees’ pay. It sends the taxes it has collected to the government 4 times a year. When must it send the next payment by?

April 15 because the test was conducted between January and March - In 2018, what will be the maximum amount of CPP contributions you can deduct from an employee's pay?

$2593.80 - You have recently registered for a GST account and have been collecting GST/HST. How would you find out when you have to pay it?

You need to look at your GST34-2 OR One month after the reporting period (Quarterly) - Your business operates seasonally, so you don't pay employees during the winter. Do you need to let CRA know this?

Yes

We used remote moderated testing on desktop and laptop computers to establish the baseline. We tested 17 participants from across Canada (14 English and 3 French). We recruited owners of small businesses, screening for those who were self-employed or sole proprietors, without prior GST/HST or payroll experience.

Participants were asked to complete all 10 tasks in one hour. If they took longer than 5 minutes to complete a task, we counted that as too long to be considered successful and had them move on to the next question.

The order of the scenarios was carefully chosen to avoid learning effects, and half the participants were given the tasks in the reverse order. Some tasks had people start on the Canada.ca home page, while others started on the CRA institution page, or on the GST/HST or Payroll topic pages on Canada.ca. An expert moderator conducted the testing.

During this first round of testing, we convened observation sessions to watch videos of the usability testing. These sessions provided an opportunity for people to better understand how usability testing works. The CRA experts who wrote the web pages saw real people using them, and typically found it eye-opening.

The results of the baseline test showed that on average, participants could find the right information 62% of the time. However, they were only able to successfully complete the tasks 48% of the time.

Redesign to improve task success

For the prototyping phase, we divided into two working teams, one for GST/HST tasks and the other for payroll tasks. Each team combed through the baseline test report, watched more videos of participants trying to complete their tasks, and looked at the click paths — the sequences of pages that participants went to. This helped show which pages were causing people to go off the “ideal” path. Sometimes this was because the correct link wasn’t clear enough. Other times a different link was more appealing.

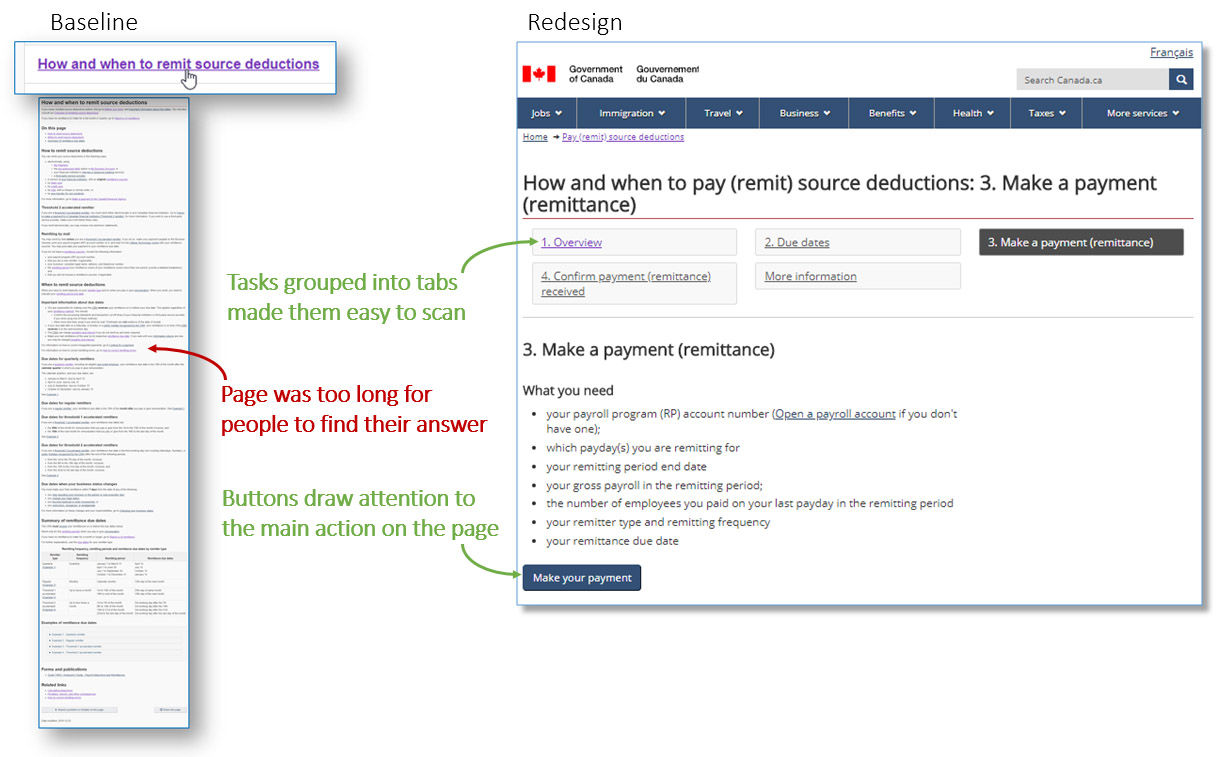

One of the primary techniques for improving citizen success was to take long pages of text, and separate sub-tasks or topics into steps. This pattern worked because it kept related information together, while allowing people to see the sequence of activities, and jump to the section that best suited their needs.

Detailed description

Two webpages are shown side by side. The page on the left is labelled "Baseline" and shows that the “How and when to remit source deductions” webpage on Canada.ca was extremely long when the project started. An arrow points to the webpage with the annotation "Page was too long for people to find their answer."

The page on the right is labelled "Redesign” and shows the “How and when to pay (remit) source deductions” page with 5 steps: 1. Overview, 2. Due dates, 3. Make a payment (remittance) 4. Confirm payment (remittance) received and More information. An arrow points to the steps with the annotation "Tasks grouped into steps made them easy to scan."

The image shows the much simpler and shorter content of tab 3. Make a payment (remittance). At the bottom of the page is a button with the text “Make your payment”. An arrow points to the button with the annotation "Buttons draw attention to the main action on the page."

We also found that people who were not familiar with tax rules did not always grasp the term “remit”. They often skipped over links to pages with that content. We could not completely replace the term remit, since it has legal connotations. Instead, we chose to bridge citizen and technical terminology by using both “pay” and “remit” in links and page titles.

Measuring success rates on the redesigned prototype

Once the revised design was ready, 25 new participants were recruited to complete the same 10 tasks. We used the same methods as the baseline test to ensure the tests could be directly compared. Our target was either 80% success, or an improvement of at least 20% points over the baseline score.

Findability rates for the revised content rose from 62% up to 90% (+28% points). Task success rates rose from 48% to 76% (+28% points).

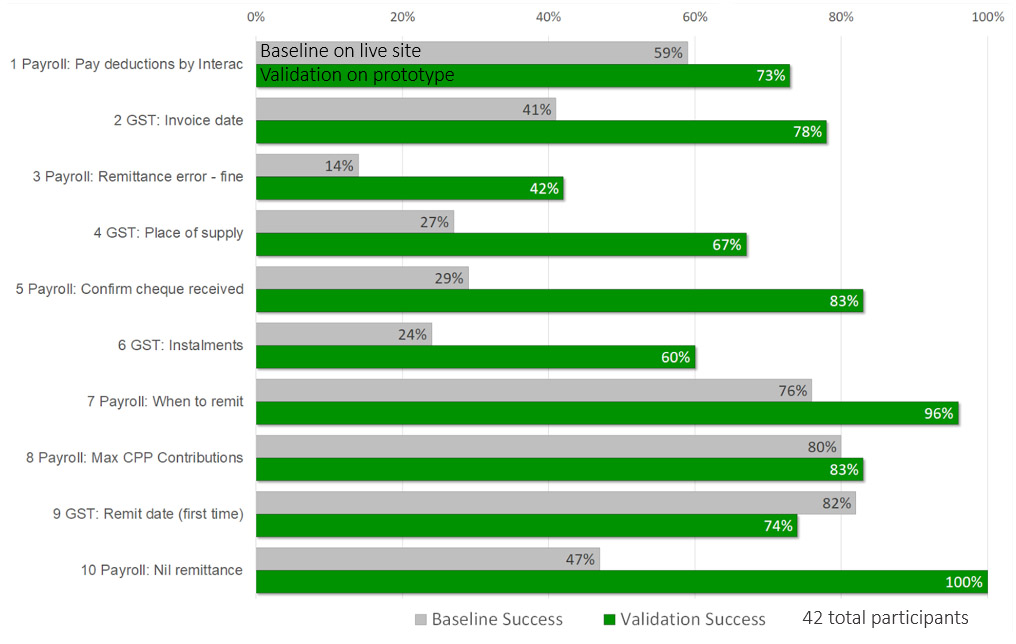

Task completion success rates – table

Baseline measurement at start of project, validation on prototype redesigned by project team.

| Task | Baseline | Validation |

|---|---|---|

| 1. Payroll: Pay deductions by Interac | 59% | 73% |

| 2. GST: Invoice date | 41% | 78% |

| 3. Payroll: Remittance error – fine | 14% | 42% |

| 4. GST: Place of supply | 27% | 67% |

| 5. Payroll: Confirm cheque received | 29% | 83% |

| 6. GST: Instalments | 24% | 60% |

| 7. Payroll: When to remit | 76% | 96% |

| 8. Payroll: Max CPP contributions | 80% | 83% |

| 9. GST: Remit date (first time) | 82% | 74% |

| 10. Payroll: Nil remittances | 47% | 100% |

42 total participants

Key drivers of success

The team summarized the 6 core changes that had the most impact on improving success rates:

- Make top tasks visible: include keywords words that users are looking for and understand in doormats and labels

- Organize for the user: organize for a user moving through tasks, rather than a CRA organized structure

- Match user language: not everyone understands terminology, reduce ambiguity and include plain language definitions

- Group tasks in sequence: a step-by-step structure provides context to tasks that are handled sequentially

- Reduce complexity: chunk complex, long pages of information into smaller pieces

- Group links together: avoid long lists of links, break them up and group like content together

Request the research

If you’d like to see the research findings from this project, let us know. Email us at cds.dto-btn.snc@servicecanada.gc.ca.

What do you think?

Let us know what you think about this project. Tweet using the hashtag #Canadadotca.

Explore further

- CRA and TBS collaborate to optimize GST/HST and Payroll webpage content, a guest post by our optimization partners at CRA

- Read overviews of other projects with our partners

Page details

- Date modified: