CRA business registration and account maintenance: Research summary

This optimization project with Canada Revenue Agency started in late March of 2018. We reviewed the most common reasons why self-employed Canadians and small Canadian businesses call the CRA. We were looking for opportunities to make it much easier for these callers to find answers and resolve issues directly on Canada.ca. The long-term goal was to reduce the volume of telephone interactions in areas that could be better served online. This will let agents focus on answering the tougher questions.

CRA Call Centre’s Strategic Planning and Operations Division did a lot of analysis to help identify the most common reasons for calls. They looked at data they gather regularly about call topics and frequency. They had also recently completed an in-depth study of business enquiries with front-line agents.

Together, we defined a set of potential task scenarios for testing. We then asked call centre agents and program area experts to validate, improve and narrow down these tasks using an online survey. This process left us with 8 task scenarios. We recruited 18 participants. They were all business students who did not have their own business number, and had never assisted a business with tax issues.

Baseline testing results

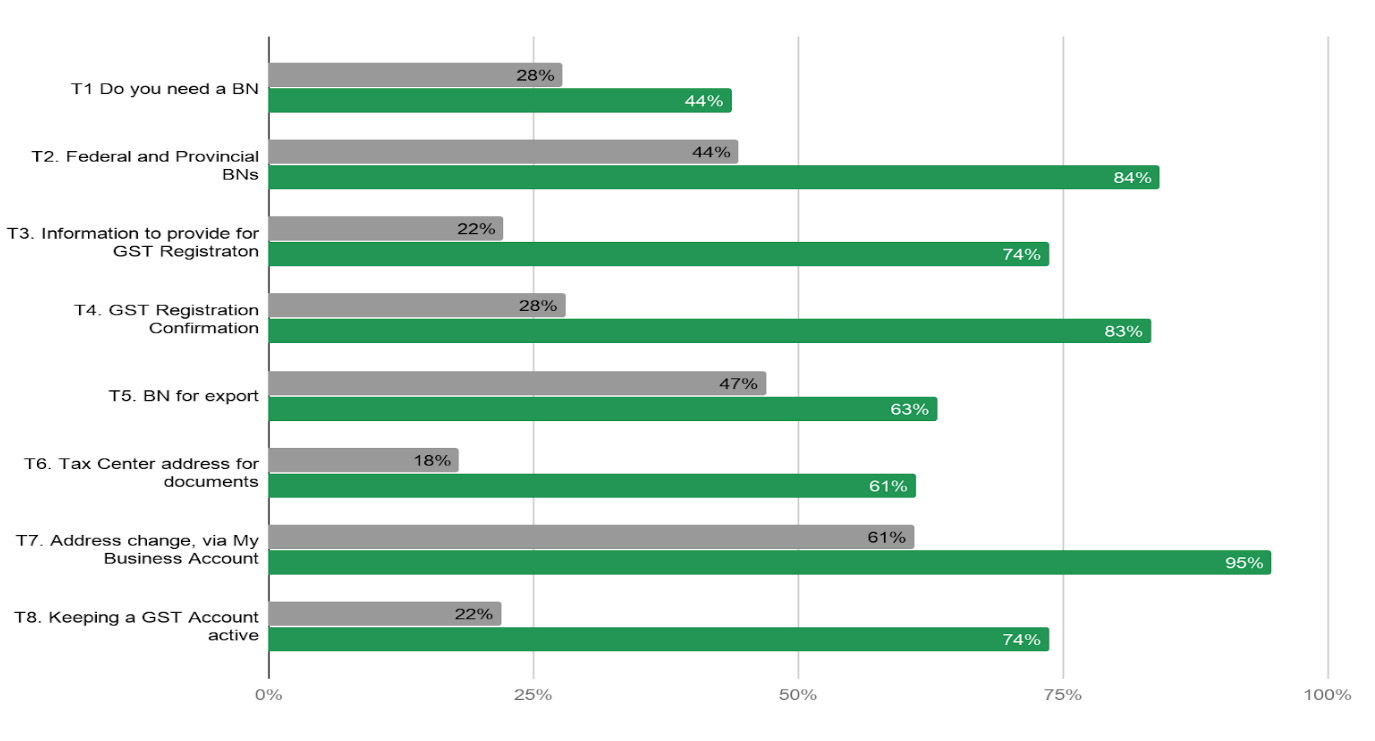

The baseline moderated task performance testing showed that, on average, the 18 participants found the right page 44% of the time. Out of a total of 142 task trials across the 8 task scenarios, participants succeeded at the tasks only 34% of the time.

The design effort

To develop an optimized prototype, designers and researchers from the TBS Canada.ca Experience Office formed a multi-disciplinary team with the Canada Revenue Agency. The team included representatives from CRA’s user experience, web publishing, Business Information Systems, My Business Account, and GST/HST programs.

Our interaction designers created the prototype in GitHub. We replicated the parts of the CRA website that we had tested. Through an intensive series of workshops, small-team discussions and individual team members analyzing video evidence from baseline testing, we made many updates and improvements to the prototype over a period of four weeks. At that point, the prototype was approved as ready for testing. If test results were positive, CRA would continue with the process to get it posted on Canada.ca.

Validation testing results

Success! Our target was to improve both findability and task success by a minimum of 20 percentage points, or to exceed 80% for both measures. In the validation round, 20 participants found the correct destination 84% of the time. That was an improvement of 40 percentage points, meeting both targets. Successful task completion increased by 38 percentage points, to a total of 72%.

Task completion success rates – table

Baseline measurement at start of project, validation on prototype redesigned by project team.

| Task | Baseline | Validation |

|---|---|---|

| 1. Do you need a BN | 28% | 44% |

| 2. Federal and Provincial BNs | 44% | 84% |

| 3. Information to provide for GST registration | 22% | 74% |

| 4. GST Registration | 28% | 83% |

| 5. BN for export | 47% | 63% |

| 6. Tax Center address for documents | 18% | 61% |

| 7. Address change, via My Business Account | 61% | 95% |

| 8. Keeping a GST account active | 22% | 74% |

How we improved

Improved scent of information

We used keywords like “registration,” “tax,” “update,” and “changes” in labels and link descriptions on Business and Taxes theme pages, menus and topic pages.

Better structuring of the information on several pages

We brought related items together, and put answers under the steps and headings where people expected to find them. We reorganized, relabeled and restructured. We streamlined a three-page list into a single page.

Reduced and simplified text

We “front-loaded” labels by putting keywords at the beginning of titles, links and doormats. We also streamlined text, so that the information most relevant to the majority of people was presented first.

Addition of a wizard

To find a correct address, we built a simple wizard. It uses a set of questions and a postal code look-up to provide the precise answer for where to mail your business tax documents.

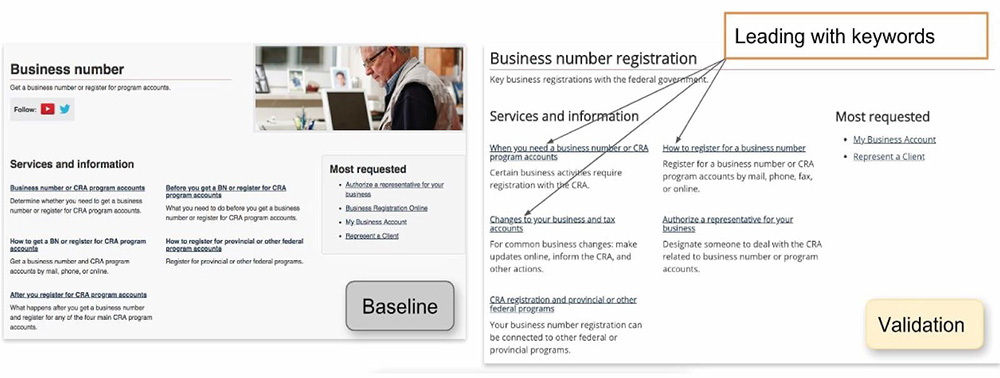

Detailed description

Two web pages are shown side by side. The page on the left is labelled “Baseline” and shows the “Business number” webpage which was missing the content that people expected to be on this page.

The page on the right is labelled “Validation” and shows the “Business number registration” page with the new topics. Arrows point to the new doormat links with the annotation “Leading with keywords.”

Request the research

If you’d like to see the research findings from this project, let us know. Email us at cds.dto-btn.snc@servicecanada.gc.ca.

Let us know what you think

Tweet using the hashtag #Canadadotca.

Explore further

- See the updated Business Registration Online pages based on the new designs in this project

- Collaborating to make business registration easier for Canadian business owners, a blog post by our optimization partner CRA

- Read overviews of other projects with our partners

Page details

- Date modified: